LET’S GET PAID!

Underwriting/Quoting Guidelines

e-App Links

🏁

Underwriting Cheatsheets

🏁

Financial Inventory

🏁

Quoting Software

🏁

e-App Links 🏁 Underwriting Cheatsheets 🏁 Financial Inventory 🏁 Quoting Software 🏁

Express Quote: Select Policy type below 👇

Step 1/4.

The Financial Inventory should be used in every appointment. Fill out the ENTIRE inventory

(All clients have different health conditions and/or financial situations).

This is where you will collect your client’s Beneficiary, their “Why / Reason” for getting life insurance, Financial information, and Health questions.

Leave NO BLANK SPACES. PLEASE COMPLETE THE ENTIRE FINANCIAL INVENTORY

Step 2/4.

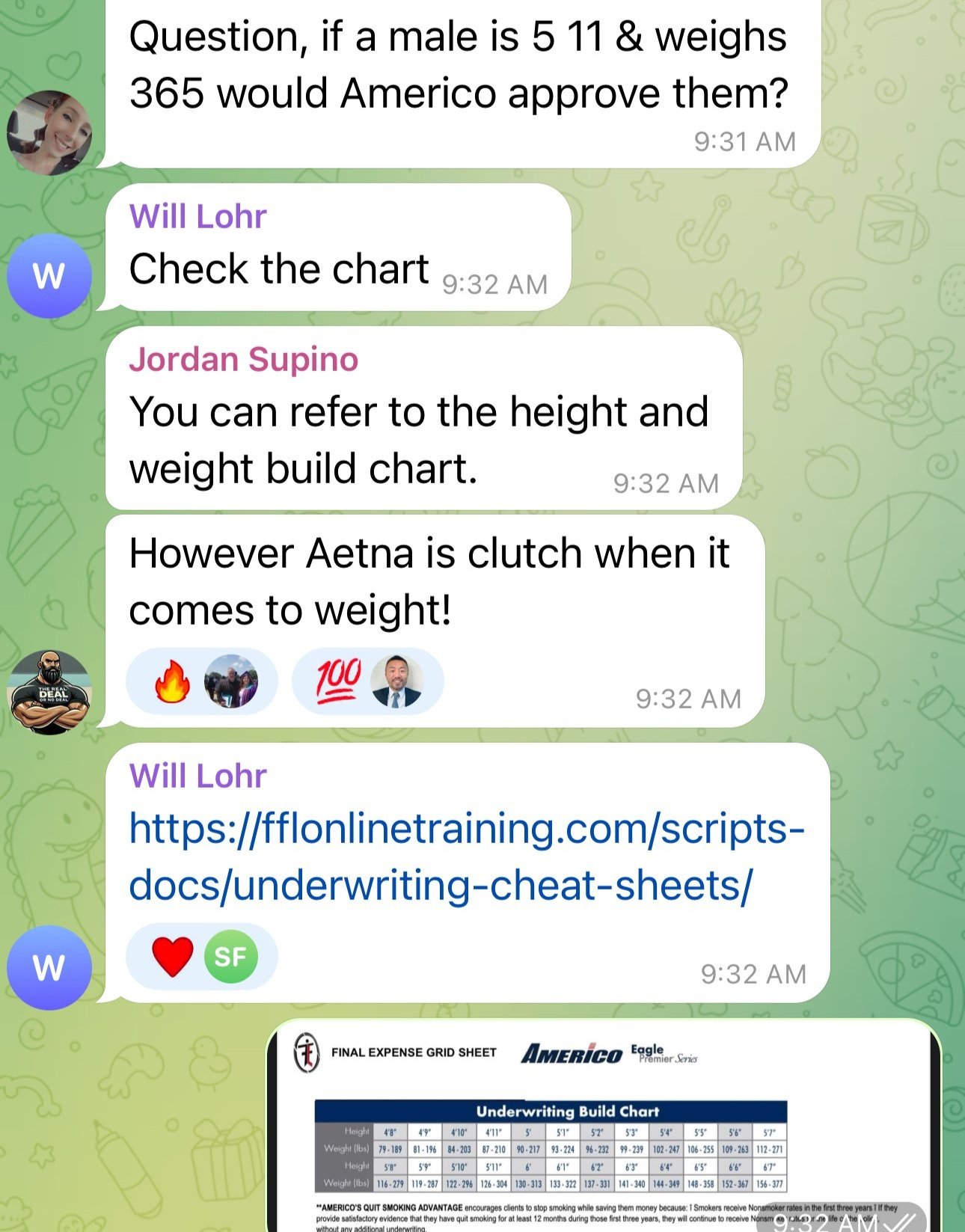

Underwriting

Cheatsheets & Medication ✓

After you fill out the entire Financial inventory (this includes the health section), it’s time to start looking at the underwriting options.

QUOTING TOOLS ARE FOUND BOTH ABOVE AND BELOW THIS SECTION.

*NOTE: If the client is completely healthy, there’s a great chance you can find an AMERICO product that fits their needs and budget.

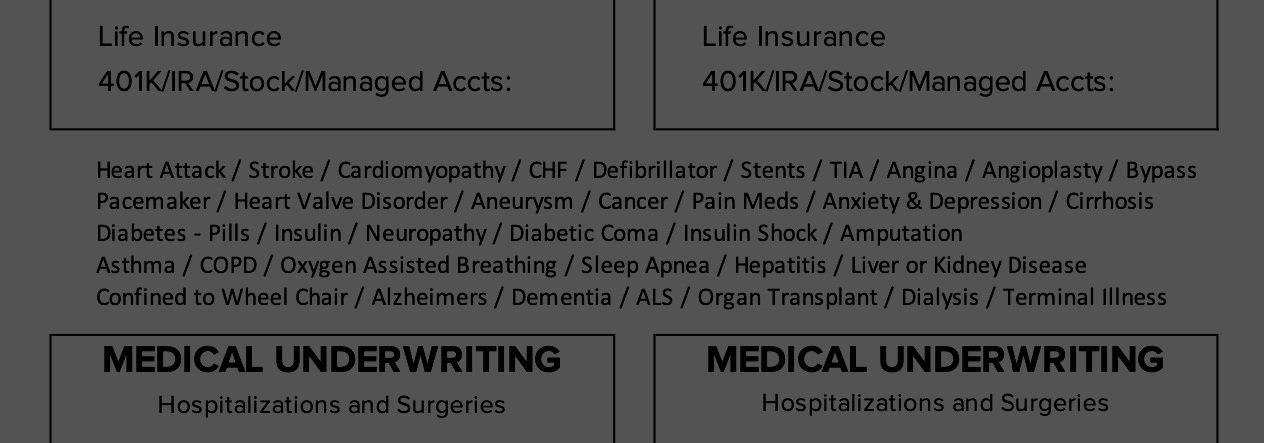

If you discover the client has Health Illnesses / Conditions, use the Underwriting Cheat Sheets (buttons below👇) to see the approval chances based on the client’s current health status.

*PRO TIP: The Underwriting Cheatsheets are in order of which Carrier is suggested (Read from left to right)

For example: For a Burial/Final Expense quote, you should lead with Americo.

If they don’t qualify- check Aetna/CVS… then AmAM…., and so on.

⬆️⬆️ This is an example of an underwriting cheatsheet. This will come in clutch for underwriting decisions!

STILL NEED HELP UNDERWRITING?

Still stuck? Need help closing the client? Reach out to your uplines via phone call or text. Sometimes a simple phone call is all you need!

Also- use the Cheatsheets, Drug Checklist, and TELEGRAM chat (Underwriting Questions Tab) until the underwriting process becomes second nature. Your uplines are just the cherry on top.

Step 3/4:

Get Policy Quotes / Options

Most agents typically leave three options (Bronze, Silver, Gold) and let the client choose the best policy. You’ll be surprised how often “the middle option” is picked.

Rule of thumb: Quote the client a policy that is around 8-15% of their monthly NET income (What’s left over AFTER bills/taxes) to make sure it is affordable on a monthly basis.

or…

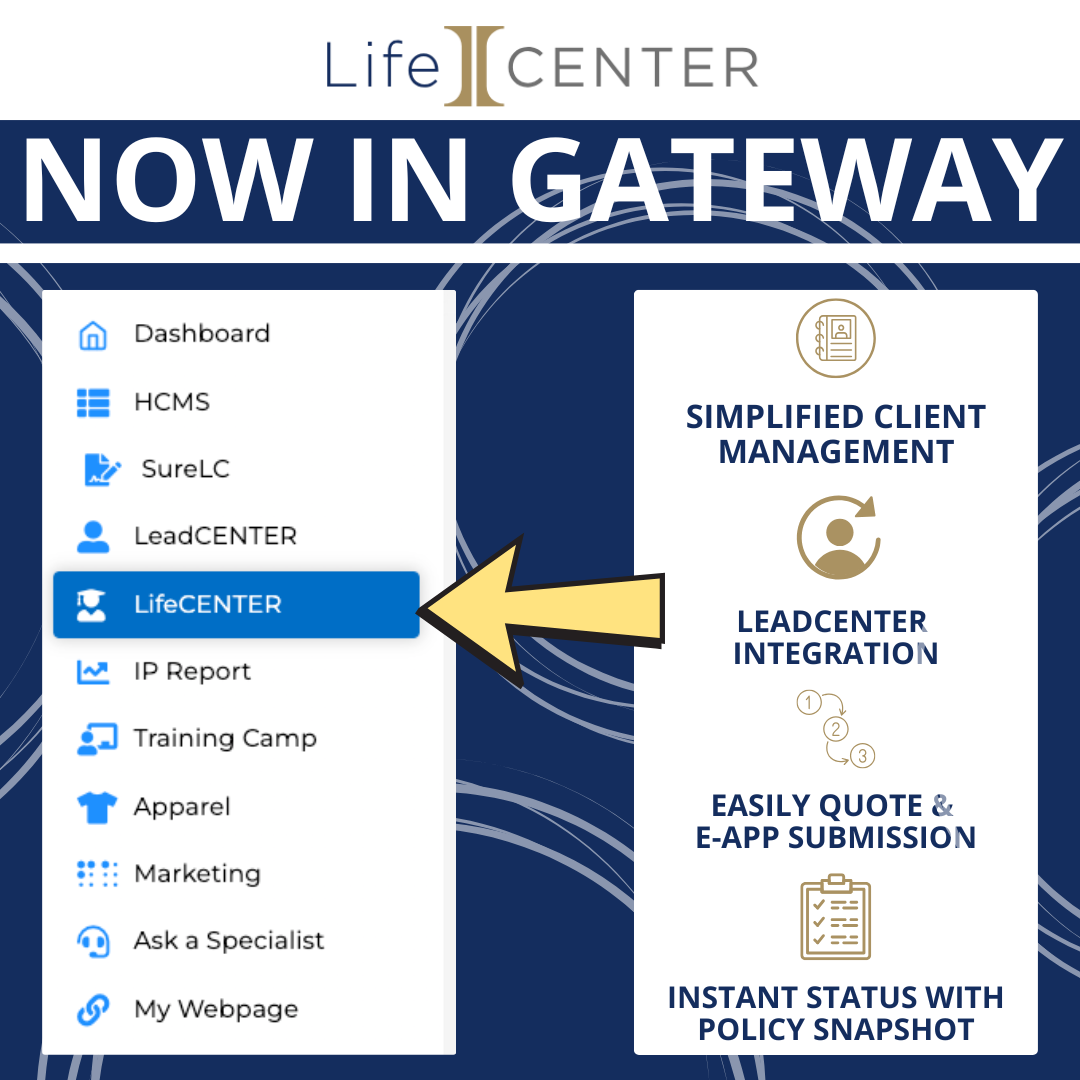

You can you Intergrity’s LifeCENTER found in Gateway! (Click HERE)

LifeCENTER connects the leads you’ve purchased from Intergrity’s LeadCENTER right into your quoting tool.

Quote ALL of the FEX, IUL, and TERM carriers you are contracted with AT THE SAME TIME!

Once you choose a carrier, you can create a new E-Application with a click of a button.

Some of your client’s data will be saved, transferred, and auto-filled into your app to save you time and stress!

Last Step (4/4):

Submit a Request for coverage!

Electronic Application (E-app)

👇 Click your desired Carrier. 👇

AFTER EVERY CLOSE:

🎉 Submit Your Sale On Telegram!!! 🎉

As soon as you get done with the sale, post the monthly premium and the name of the carrier you wrote.

Get in the habit of posting every sale on Telegram! 🤪

Post under the “🏆 Daily Sales & Wins” thread

Example 1:

“ $147/ mo Aenta/CVS”

if you write multiple apps, explain the sale detail.

Example 2:

“ His & Hers “

$214.13 / month Americo Eagle his

$78.50 / month AmAm hers

Example 3:

“ Mom and Kid”

$128.46 / month MoO (Mutual of Omaha) Living Promise

$17.95 / month MoO children’s whole life”